2012 in Review- An Appraiser’s Personal Perspective

December 24, 2012 at 7:44 pm | Posted in Uncategorized | 1 CommentTags: advantage appraisals, appraisal, approach to value; market value, arizona, foreclosure, gilbert, maricopa county, Multiple Listing Service, pool, queen creek, short sale

In November 2011, after a long search for our next home, my family was in escrow with plans to close by Christmas. We told the kids that we wouldn’t decorate our current house but would make that the first priority in the new house- a week before Christmas. This was a resale home in a neighborhood that we had been eyeing for some time. It needed minor updates but was ideal for many reasons. As an appraiser who had been looking to move for the prior two years, this was the end of a long and painful process. You see, I’m too smart for my own good…

As an appraiser, I’d like to think I have a pretty keen sense of the real estate market (like a financial planner does…). I can quickly estimate the value range of a home and I know good neighborhoods. As the real estate market was in its nadir in 2010, we were just looking for the right deal. On top of that, besides appraising homes all over the valley, I worked for a servicer of Fannie Mae defaulted loans, doing nationwide appraisal fraud investigation- so I knew that the pipeline for distressed homes was endless- think the Sta-Puft Marshmallow man of shadow inventory.  I would not overpay, and it was a buyer’s market. I have friends who buy houses at auction- fix and flippers. We weren’t looking to get in that game ourselves, just use those sorts of resources to get a home at auction. But we don’t have the cash available to buy a houe outright. We’d need traditional financing.

I would not overpay, and it was a buyer’s market. I have friends who buy houses at auction- fix and flippers. We weren’t looking to get in that game ourselves, just use those sorts of resources to get a home at auction. But we don’t have the cash available to buy a houe outright. We’d need traditional financing.

However, this proved to be more difficult than anticipated. At first my wife and I were very particular about neighborhoods. We’d research the homes coming to auction over the next 60 days, check them out and then put in a bid. However, so many auctions were cancelled or postponed, that the ratio of homes actually going to auction on the dates scheduled was like one in ten. So despite this arduous research and planning, we were only able to bid on four houses during a year’s span- and in every case, we lost out by just a few thousand dollars.

This process was made worse by the fact that we had previously seen short sale listings- that take forever to close, and they actually closes during the time that we had been searching through our process. A friend of mine actually put in a bid on short sale and has subsequently moved in. So with this in mind we decided to expand our search to the Multiple Listing Service. Through this process, we actually found a home that fit our criteria and placed a full price offer on a home that appeared to be slightly undervalued. Our good friend loan officer told us that we would have no problem with the loan- despite a HAMP loan mod in 2010- and we didn’t even need to rent out our current house (though we would)!

Well, as my wife worked at a bank, her in-house lender got wind of our move and asked “why don’t you do the loan through the bank? It will essentially be a free loan since you’re an employee.” At this we decided to have the in-house lender do our loan. Our friend told us that he couldn’t beat that deal and we decided that it was the best route to take to save a few bucks…

We un enrolled the kids from their schools, their classmates threw them going away parties and gave them goodbye cards, we met up with some renting friends from the neighborhood for a little celebration, got a carpeting quote and placed a down payment through Home Depot, we had the inspection done and we had the appraisal done. We even had a tenant lined up with rent several hundred above our mortgage payment. All was well- until the loan officer told us that loan wouldn’t go through because of our loan modification- despite the fact that they were already aware of it and said it wouldn’t be a problem. But not to fear she told us, she had another lender who said they could do the deal- it would just take another two weeks. A week later and now the middle of December- the day after school let out for Christmas, we were told that this second lender had also balked at our loan. We were devastated and slightly pissed off and we started venting about it with our friends. Everybody and their brother heard of our plight and assured us that they knew someone who could do our loan- even our friend lender who we were supposed to work with from the get go. He was astonished that our loan was dead and assured us that his in-house underwriter was already aware of our situation and was ready to fund our loan.

However, this would mean another three weeks minimum as we’d be starting from scratch. We’d be pushed out to mid January, school would have already started, and still, we had doubts that it would go through. The president of my wife’s bank actually approached us and offered to give us a private loan for 12 months until we could get conforming financing (they don’t keep residential loans in house). We respectfully declined. So after some praying and discussion, and insight from a local real estate expert… my wife and I decided to back out of our deal completely with the notion of starting from scratch in the new year. Total out of pocket expenses- $250 for the inspection, $400 for the carpet down payment. But we had already packed our entire house so our garage was filled with stuff- ready for the move.

Christmas was fine with a rush decorating job but we were happy nonetheless. Kids were a little confused but started up school again in our district at their old schools.

In January, we found a remodeled house in the MLS. We threw caution to the wind and placed a full price offer the day it was listed (through our original lender) and lost out to a cash bidder who offered less.

At about the same time, I appraised my first home in a brand new tract of a neighborhood that had been heavily depressed over the past several years. This house was selling for $30,000 more than resales of the same utility! I was astounded. I subsequently did about 30 houses in that subdivision and whenever I went there, people were packed in the sales office. Competitior sales offices were also packed.

In February, the loan officer from my wife’s bank WAS FIRED for INCOMPETENCE!!!!!!

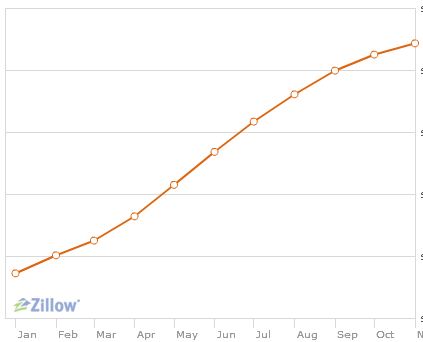

We placed an offer on another MLS house- full price, lost out to a cash buyer. A friend who fixes and flips and did over 50 deals in 2011 had gone through the first quarter of 2012 wihtout finding a single house. Investors had started to pay 10 percent over “zestimate” on auction homes- simply to get the homes and in most cases rent them out immediately. Another fix and flipper had reworked his margins but was having a slower year. My wife started unpacking boxes in about April. We discovered clothes that we forgot we had. I appraised many more homes with increasing prices. We found none for ourselves. My work doing Fannie Mae Appraisal Fraud review continued robustly. There was a never ending supply of bad loans. Yet the talk of the press was “recovery” and it was legitimate. Or was it?

Sales were up, but in most cases- at least in Phoenix, it was investors, and they were paying cash. The common man (AKA me) couldn’t buy a house despite being qualified. And we couldn’t exactly overbid because of the fear of the appraisal coming in low and not having the funds to make up the difference.

In our favor was the fact that we never had to move in the first place. Our house is beautiful and big enough for us and more. We have views of two mountain ranges, are on a golf course and have a beautiful oasis pool that my wife designed herself. We have a very good (modified) loan and our payment will stay low throughout its duration. By the way, our renter friends whom we celebrated with a year ago? They literally justed moved into their new construction home last week.

Am I too cheap? Am I too conservative? Am I too “smart” for my own good- despite the countless lost opportunity costs associated with being frugal? The answer is undoubtedly YES with a little sarcasm around the quoted “smart”. The house we were in escrow with is now worth 20-percent more. There are very few homes on the market that we like and now they are listed for 30-percent more than they were a year ago, and quite frankly, we can’t afford that.

The good news is that all our moving boxes are out of the garage so we can park our cars there, we painted some rooms that needed it badly, and our home value has also gone up about 30- percent- but we’re still $60k in the hole. From a personal perspective, we ended up where we started, but from a professional perspective, I can confidently tell you that whatever reasons you use to explain this recovery, it has been legitimate in 2012. Where will things go in 2013? If you can’t figure me out already, I have faith that the combination of fiscal cliff, high unemployment, increasing entitlements and lack of “real” buyers will cause things to slow down if not reverse- sort of a dead cat bounce. But since I’ve made that proclamation, you can rest assured that we’ll continue to go up! Have a Merry Christmas and Wonderful New Year filled with happiness, and good fortune!

Visit our website at http://www.advantageappraisalsllc.com, and if that doesn’t roll off the tongue, just try http://www.appraiserdude.com. Or now you can follow us on Twitter at @appraiserdude AND we just added a Facebook page for you to “like” at http://www.facebook.com/appraiserdude. Give me a call at 480-544-1217 if you have any questions. I look forward to working with you.

Create a free website or blog at WordPress.com.

Entries and comments feeds.